“Taking the initiative of managing the Company Assets today will make your business an Asset tomorrow.”

The physical assets held by a company plays the crucial role of being one the most active element that completes an organisation to perform its business activities. These assets hold high value and are ultimately represented in a company’s balance sheet that mandates the organisation to manage the assets properly to utilise them effectively and efficiently over time.

The company incorporation process in UAE demands the management of the business assets after a certain period irrespective of the size or nature of business the company holds. Being a business owner or an entrepreneur, it becomes a mandate to fulfil the requirement soon. If you own an established business, family business or a newbie in the business segment and planning to set up a company in UAE, then it is the right time for you to know about the essentials. This treatise will give you in-depth information regarding what ‘Asset Management is all about in relation to Family Office and Private Banking and how it can help your business in the long run. Let’s dive in.

What is Asset Management?

The term Asset Management is an approach initiated within an organisation wherein the physical assets owned by the business are viewed as priorities that need to be maintained to grab the best out of them in the long-run.

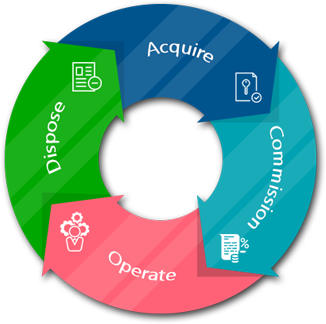

The core concept is to recognise the lifecycle of an asset, understand the potential risk associated with owning the assets. The Lifecycle of an Asset has been depicted below.

Now, you must be wondering “Why?” Well, the answer to your query lies in its importance.

Why Is Asset Management Important?

The implementation of Asset Management can benefit your organisation in the following ways:

- Low Capital and Operation Cost to a great extent

- Improves the health of the Company Assets which makes them last longer

- Reduces the Environmental impacts of the Assets

- Low Risks related to Operation of Assets

- Enhances the Regulatory Compliance of the organisation

- Improves the Reputation of the organisation

By now you must have got a clear understanding of what Asset Management is all about. The existing business structures in Dubai have already adopted this concept. Meanwhile, another concept emerged into the Corporate World of Emirates termed as ‘Family Office’ which focuses on managing the wealth for your future generations. To understand it better, let’s proceed ahead.

What Is a Family Office?

A Family Office is a new concept in the Wealth Management category. It is an advisory firm that serves high net-worth investors. They provide tailored solutions to manage the wealth held by an individual for its future. In simple words, we can say that the Family Office is a professional set-up designed with an aim to manage the wealth held by an individual for its family security and future generations. This family controlled investment group can be categorised as:

Single Family Office (SFO)

A single-family office is an organisational structure that focuses on the wealth management of one single wealthy family. The overall wealth of the family is accumulated over generations. Specific services that are taken care of by the SFO includes property management, day-to-day accounting, payroll, legal affairs etc.

Multi-Family Office (MFO)

On the other side of the coin, Multi-Family Office that is an extended version of the Single Family Office. It has been built to provide customised solutions and responsive service to multiple families to manage their entire wealth.

Reasons to Incorporate a Family Office in the UAE

The main reason behind the incorporation of Family Office are:

- Manage family expenses which occur on daily grounds as well as for Family Support

- Provide a driver to manage the Family Wealth and Investments made

- Privacy and Confidentiality concerning the handling of Family’s Wealth

- Better Financial Management over a while

Another division of Asset Management that adds value to the business is managing the Private Wealth.

What Is Private Wealth?

The division of Private Wealth Management is an advisory practice that involves financial planning, portfolio management. The whole idea of Private Wealth Management is to solve financial issues and enhance the financial situation of an individual or family business. A Private Wealth Manager is assigned to carry out the financial tasks and deliver a full range of financial products and services to the respective clients. It is to be kept in mind that good helping-hand can always make your company grow to the next level.

How We Can Manage Your Asset

It can be clearly understood that Wealth Management is a tedious job that involves a lot of calculations and complications. Assigning such tasks to professional experts turns out to be more feasible as they are subject-matter experts and are well-equipped with the legal laws. Commitbiz is a premier business consultant in Dubai, who holds years of experience in the field of business incorporation.

Ranging from the incorporation procedures till establishing the core pillars like Accounting, Financial Management, Asset Management, Visa Services our experts take utmost care at every step while delivering the service. By partnering with us, you will be able to avail the following services:

- On-time Project Delivery

- In-depth analysis on the financial domains of the company

- A clear idea on the future wealth management goals

- Building financial strategies to strengthen the financial ground of the business

- Experts’ Advice during the Financial Planning Process

If you have any doubt or want to know more about it, do contact us - we’d be glad to assist.