To run smooth business operations, a business entity ends up making huge investments. Be it buying machinery or hiring an employee, a company needs to undergo an in-depth analysis and incur the final cost.

Once you have made up your mind about setting up a business in UAE, be it a start-up or expanding an established one, it’s time for you to learn about External Asset Management in Dubai. Let’s dive in.

Now, the investment decision turns out to be challenging as well as the assets purchased are to be maintained adequately. The decision becomes more valid if an expert investigates the matter and presents their viewpoints.

The United Arab Emirates is a known business platform that attracts millions of newbies as well as experienced business professionals. The nation also demands that business organizations have a word with External Asset Managers to get a better understanding of Asset Management, improve liquidity and grab the best investment opportunities.

The Concept of External Asset Management Companies in Dubai

The rising number of business setups in Dubai and entities in the global world has proportionately increased the demand for the maintenance of company assets as well as the maintenance of company wealth. Initially, this was handled by private banks, but then the concept of entrepreneurship provoked the relationship managers to take a step forward and establish EAMs.

Now, you must be wondering what EAM is all about. In short, we can say that an EAM firm acts as a catalyst that helps business entities to understand investments, handles the core business assets, and provide tailor-made solutions according to the industry requirements.

It is a standalone company that is independent of banks. To ensure continuous support, an External Asset Manager comes into the picture.

Let’s understand who he is and how he helps.

Who is an External Asset Manager?

An asset manager can be stated as a wealth manager who provides extensive services to business clients to manage funds for individuals as well as companies. They are subject-matter experts who are known for making timely investment decisions.

An asset manager helps a business to diversify the investment portfolio, which ultimately helps to boost the goodwill of the company. Let’s take the next step of understanding how EAM works.

How Do the External Asset Managers in Dubai Work?

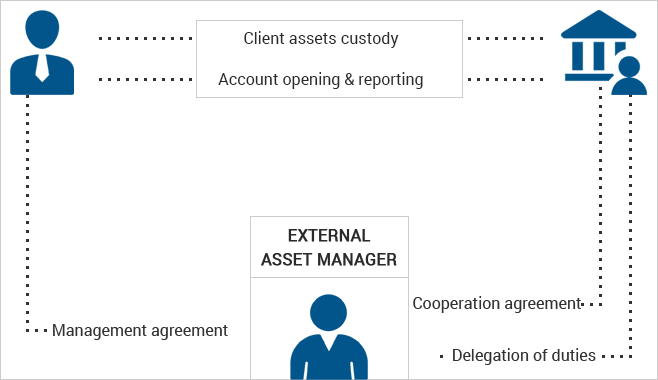

EAMs are subject-matter experts who work according to the following model

Advantages Of Availing EAM Services and Starting Asset Management Firms in Dubai

When it comes to availing the EAM Services, an entrepreneur or an established person can avail of the following benefits:

- Solutions as per Requirements

- Portfolio Diversification

- Enhance Goodwill

- Fix Loopholes

- Highlights the Investment Opportunities

- Business Model

- Business Expansion

- Better Clarity

- Cost-Cutting & Operational Movement

- Expert Advice.

Note: External Asset Managers can’t withdraw or transfer funds directly, and control remains in the hands of the business owner.

Our Offerings

Commitbiz is one of the best business consultants in UAE who has been helping more than 1000 clients across the globe to incorporate their business entities. Moreover, we extend our helping hand to our clients for better asset management services in Dubai.

Our External Asset Management Services include the following:

- Custody Solutions and Reporting

- Wealth and Estate Planning

- Provide Insurance Solutions

- Fiduciary Solutions

- Asset Location

- Best Execution Practice

- Credit and Lending Solutions

- Alternative Investments/ Hedge Funds/ Private Equity/ Real Estate

- Discretionary Portfolio Management

- Foreign Exchange/ Commodities

- Equities/Fixed Income and Mutual Funds.

Our wealth advisors will understand your business requirements and cater to your needs accordingly. If you hold any doubt or want to have a word with our consultant to take your first step, do contact us-we’d be glad to assist.

What is EAM all about in Dubai?

We can say that an EAM (External Asset Management) firm acts as a catalyst that helps business entities to understand investments, handles the core business assets, and provide tailor-made solutions according to the industry requirements.

Who is an External Asset Manager?

An asset manager can be stated as a wealth manager who provides extensive services to business clients to manage funds for individuals as well as companies. They are subject-matter experts who are known for making timely investment decisions.

How does an external asset manager in Dubai work?

They work according to the following steps:

Client Assets Custody

Account Opening and Reporting

Management Agreement

Cooperation Agreement

Delegation of Duties.

Can external asset managers withdraw or transfer funds directly?

No, the control remains in the hands of the business owner.

What are the benefits of availing of EAM services in Dubai?

The benefits of availing the external asset management services in Dubai are as follows:

Solutions as per Requirements

Portfolio Diversification

Enhance Goodwill

Fix Loopholes

Highlights the Investment Opportunities

Business Model

Business Expansion

Better Clarity

Cost-Cutting & Operational Movement

Expert Advice.